Navigating HMRC’s Time to Pay Arrangements: A Guide for Businesses

Learn how to manage and spread your tax liabilities, including VAT, PAYE, Corporation Tax, and Self Assessment, over a manageable period.

What is the right size and shape for my Digital Agency?

Discover how to optimise your Digital Agency for success by finding the perfect size and shape with our Capacity Plan model

Six reasons why business owners should use Compass

Managing both your business and personal finances can be overwhelming. Take our questionnaire and find out how Compass can bring clarity and efficiency to your financial life.

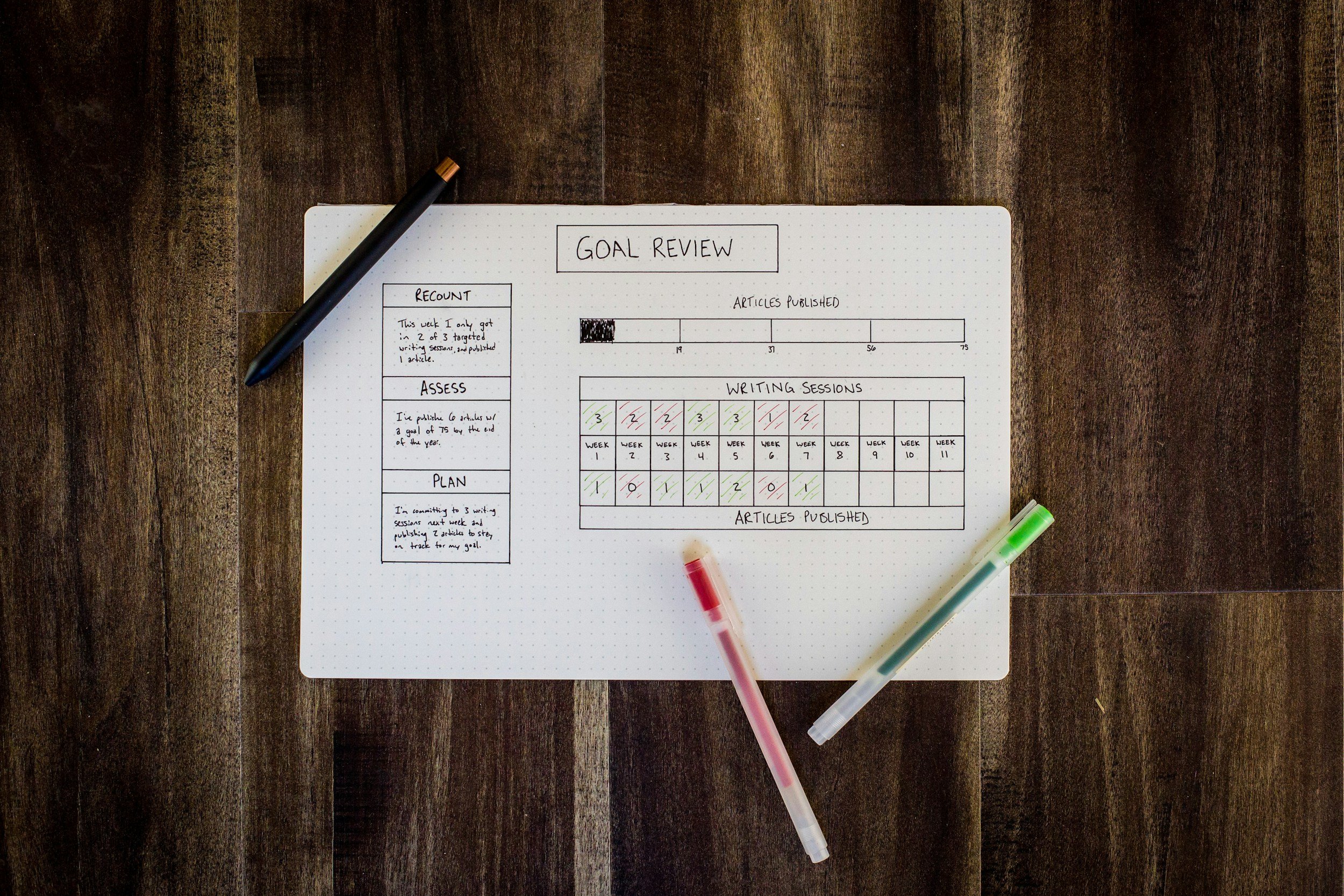

Goal Setting: Building the right business for your personal goals

Discover the importance of clear goals and financial modeling in decision-making, and how our Lagom goal-setting tool simplifies the process for owner-managed businesses.

Cash Flow

"Never take your eyes off the cash flow because it’s the lifeblood of business," said Sir Richard Branson, a crucial reminder for agencies of all sizes to understand and proactively manage their cash position through regular forecasting and review to ensure financial health and sustainability..

Streamlining Payments

Explore the importance of cash flow forecasting, its components, and strategies for optimizing cash management.

Does Your Small Business Need An Accountant?

A lot of small business owners don't think they need a financial consultant/advisor. However, if you’ve already got a steady stream of income and clients under your belt, it might be wise to start looking for a financial partner sooner in your journey rather than later.

Reasons to Swap Spreadsheets for Cloud Accounting Software

Many small business owners have been using spreadsheets to do their accounting for years now. Whilst spreadsheets may seem like a convenient and cost-effective way of managing your finances, advances in cloud accounting software mean that your business could most likely benefit from an upgrade.

How to Break Up with a Client in a Professional Manner

When you first started your business, it probably felt as though finding clients was all that mattered. However, as your company grew and you refined your focus, you probably came to the realisation that certain relationships were no longer serving you… and now you’re not sure what to do about it.

Tips for Improving Your Organisational Skills

Everyone who wants to run a business or manage a team has to develop their organisational skills. This isn’t always something you're born with, though it comes more naturally to some! In fact, everyone can improve their organisational skills with a little practice. Here's how you can improve those skills.

Cash Flow vs Profit: What’s the Difference and Which is More Important?

It’s an age-old debate: cash flow or profit? Whilst the two are undoubtedly related, they are certainly not the same thing and business owners must often sacrifice one at the expense of the other. In the long term, a business needs both positive cash flow and profits to continue operation, but which one should entrepreneurs be prioritising?

5 Common Tax Deductions that Small Business Owners Often Overlook

Paying tax is inevitable but there are things you can do to reduce the percentage of your income that the taxman takes. As a small business owner, the likelihood is that you’re probably paying too much tax, which is why we’ve put together a list of the most overlooked deductions to help you reduce your bill.

Small Business Management Tips that Will Make Your Life 10x Easier

There’s nothing quite like being your own boss, but running a small business can be a headache at times, too. We have put together a list of tips to help you better manage your people, time and money so that you can stop stressing and enjoy the wild adventure that is entrepreneurship.

How to Manage Cash Flow During Uncertain Times

The cost of living crisis, economic pressures and continuing to recover from the effects of the pandemic has thrown the world into (further) uncertainty. Which is why it's vital that small business owners take charge of their cash flow now.

How to Combat Stress as an Entrepreneur

Being an entrepreneur is stressful no matter the size of your business. From those starting out to the well seasoned pros, we all feel stress in different areas. Whilst it’s true that stress is part and parcel of entrepreneurship, there are plenty of realistic ways to manage it.

What the mini budget means for your business

What does the mini budget mean for you and your business. The Chancellor, Kwasi Kwarteng, delivered his first mini-budget on Friday 23rd September 2022, with a lot of changes affecting both individuals and small businesses.

How to develop a CEO mindset

Even if you don’t consider yourself a CEO there’s no reason you can’t or shouldn’t develop a CEO mindset. As women in business we often have a tendency to downplay our efforts and achievements. Perhaps you’re guilty of saying, ‘I’m just doing this on the side’ or ‘it’s nothing really’ about your business.

Going from freelance to agency

Going freelance is a big step but what about after that? You might have been freelancing for a few years, maybe even a few months, and for many, working as a solo act is the dream. For others, up-skilling and scaling up becomes the obvious next step. Whether you’re a marketer, designer, accountant or PR, starting an agency is often the rung on the career ladder.

Financial Freedom: how to quit the commute and embrace remote living

With the advent of lockdown, a huge majority of working women in the UK were pressed to embrace a new remote form of work. For some, working from home and checking in with the office via Zoom has allowed time to focus on passion projects, to make money plans and use the new-found flexibility to achieve financial freedom.

We caught up with Stacey Lowman to discuss her decision to follow financial freedom by way of a nomadic life on the road.

How to take control of your finances and achieve financial wellbeing

Take control of your finances! Achieve financial wellbeing! We're often bombarded with statements like this, especially on social media. But what does it mean to actually take control of your financial situation and what is financial wellbeing?

I spoke to Freya Tanner about Money Dates, Profit First and all things finance.