Navigating HMRC’s Time to Pay Arrangements: A Guide for Businesses

Learn how to manage and spread your tax liabilities, including VAT, PAYE, Corporation Tax, and Self Assessment, over a manageable period.

What is the right size and shape for my Digital Agency?

Discover how to optimise your Digital Agency for success by finding the perfect size and shape with our Capacity Plan model

Six reasons why business owners should use Compass

Managing both your business and personal finances can be overwhelming. Take our questionnaire and find out how Compass can bring clarity and efficiency to your financial life.

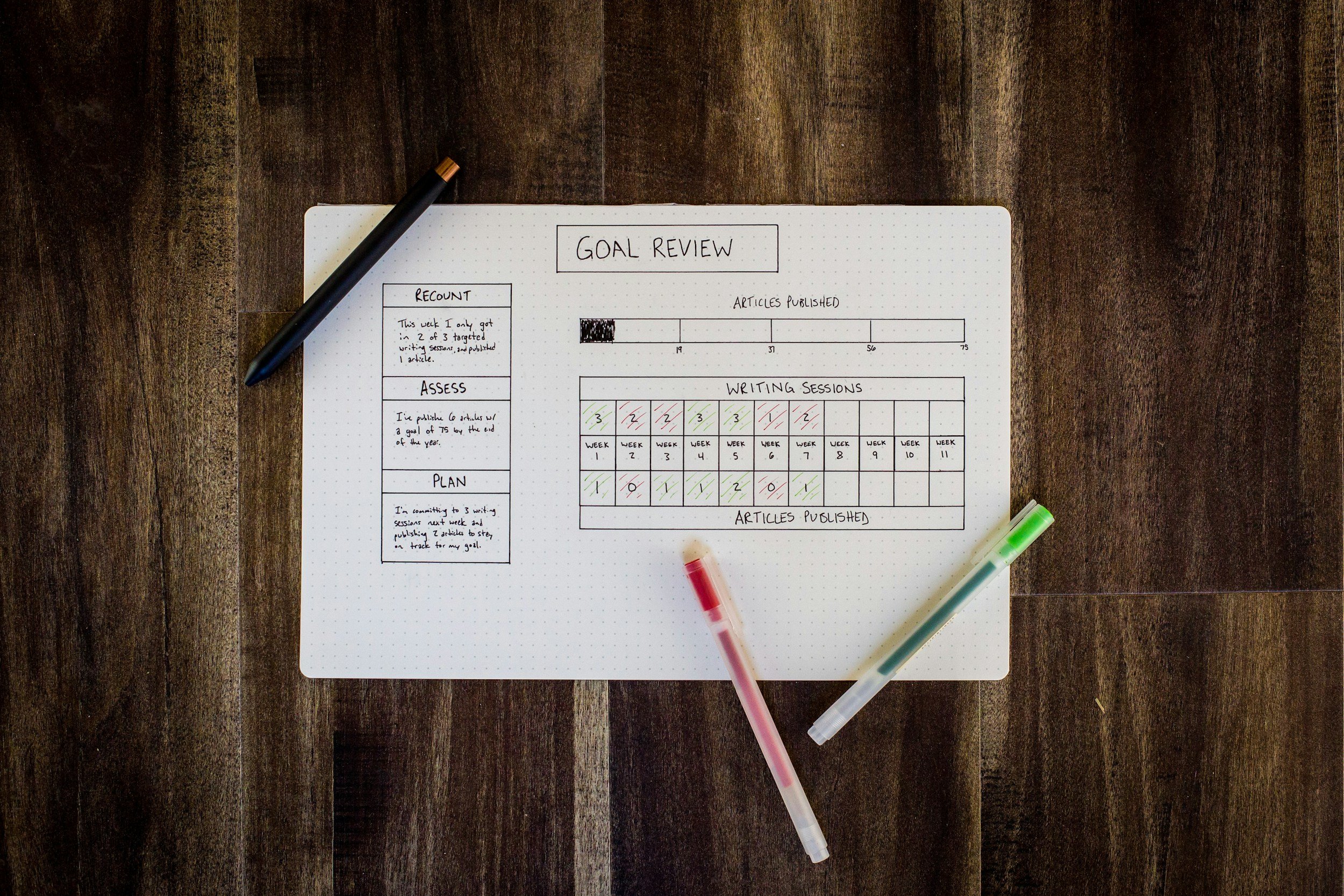

Goal Setting: Building the right business for your personal goals

Discover the importance of clear goals and financial modeling in decision-making, and how our Lagom goal-setting tool simplifies the process for owner-managed businesses.

Cash Flow

"Never take your eyes off the cash flow because it’s the lifeblood of business," said Sir Richard Branson, a crucial reminder for agencies of all sizes to understand and proactively manage their cash position through regular forecasting and review to ensure financial health and sustainability..

Reasons to Swap Spreadsheets for Cloud Accounting Software

Many small business owners have been using spreadsheets to do their accounting for years now. Whilst spreadsheets may seem like a convenient and cost-effective way of managing your finances, advances in cloud accounting software mean that your business could most likely benefit from an upgrade.

Cash Flow vs Profit: What’s the Difference and Which is More Important?

It’s an age-old debate: cash flow or profit? Whilst the two are undoubtedly related, they are certainly not the same thing and business owners must often sacrifice one at the expense of the other. In the long term, a business needs both positive cash flow and profits to continue operation, but which one should entrepreneurs be prioritising?

5 Common Tax Deductions that Small Business Owners Often Overlook

Paying tax is inevitable but there are things you can do to reduce the percentage of your income that the taxman takes. As a small business owner, the likelihood is that you’re probably paying too much tax, which is why we’ve put together a list of the most overlooked deductions to help you reduce your bill.

How to Manage Cash Flow During Uncertain Times

The cost of living crisis, economic pressures and continuing to recover from the effects of the pandemic has thrown the world into (further) uncertainty. Which is why it's vital that small business owners take charge of their cash flow now.

What are payments on account?

Payments on account are tax payments made twice a year by self-employed people to spread the cost of the year’s tax. They're calculated based on your previous year’s tax bill, and are due in two instalments.

Surviving the pandemic as a sole trader

The pandemic has affected all of us in some way or another but for some the impact on their business has been hard. With smaller businesses falling through the cracks for support, I caught up with Nadia Harper to learn how she pivoted her business over the last 6 months.

Choosing the right accountant for your business

Choosing the right accountant can be a really important decision for your business. It’s should be a good fit and you should have a great working relationship.

Sole trader vs. Limited Company?

Deciding on a business structure can be a daunting experience. Here are some key things to consider.